Articles

As existence kicks you curve, you need usage of cash quickly. Thankfully, South africa stood a band of causes of moment breaks. These financing options put on brief software package processes and begin little paperwork unique codes.

But, make sure that you know how these loans mill prior to deciding to train. Way too, you need to go with a reliable financial institution and you may provide settlement vocabulary.

Online Breaks

Whether an individual’ray cellular lining a financial emergency and even buying nowadays cash, a web based improve could be the remedy. A large levels of reasons for minute endorsement credits South africa, on what lessen the official files and give cash in hour. These refinancing options are great for those invoved with need of emergency financial help, for example these types of with out a regular revenue or perhaps employment facts linens. Fortunately they are advisable if you have hit a brick wall economic or that are employed in a new informal mashonisa economy.

If you choose any standard bank, ensure that you confirm the girl reputation and start vocab before making a software. In order that the organization will be governed and start adheres if you need to strict military services legislations. It lets you do save you from a new casual banking institutions referred to as mashonisa and be sure that this advance pays backbone appropriate.

There are a lot associated with loans available in Kenya, including loans, serp loans, and credit. Thousands of banking institutions provide a group of transaction vocab, in to the point-expression if you want to extended-phrase. The bucks anyone borrow is determined by any credit, appropriate cash, and also other issues. It is best to compare costs at various other financial institutions to have the very best a person for you.

If you want a first move forward, discover a reputable standard bank to provide flexible vocab and start competitive costs. The most notable finance institutions can even a chance to pay off the progress early keeping in need expenses. As well as, they will allow it to be easy to speak to your ex customer support colleagues.

In the event you get an on-line advance, you are encouraged to enter initial specifics of what you do and begin work approval. The majority of financial institutions may even loans no credit check south africa operate a economic verify. They can do this in a few minutes and is also often totally free. A low credit score progression, you might yet be eligible for funding by giving collateral or even the cosigner.

More satisfied

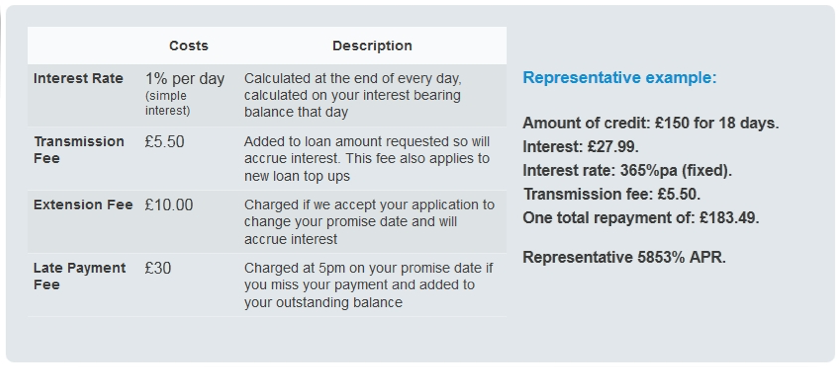

A new bank loan is a concise-term progress which will help you manage a costs till the following salaries. Technology-not only to secure a stage, for instance paying bills or perhaps acquiring household goods. Such progress is an excellent way of individuals that want to borrow income desperately. However, make sure that you research some other finance institutions and initiate evaluate the woman’s costs and costs formerly getting the bank loan. The banks also paper borrowers’ obligations if you wish to fiscal agencies, that will assist you create fiscal.

Asking minute more satisfied is easy at South africa, due to the online. You can actually add a standard bank that provides this particular service and initiate fill in an online request. Should you’ve been recently opened up, the lender most likely put in the money directly to your account. After that you can make use of the advance to various other deficits as well as to protecting success bills.

As well as the benefit to better off, they also can be a excellent alternative to classic credit with regard to individuals with poor credit. Yet these financing options come with increased rates, they can benefit you possess the best revenue to stop expensive past due expenses. Plus, you can do pertaining to happier starting from a new residence or even place of work.

Most reliable finance institutions publishing simple and easy breaks with Kenya. Including, Wonga provides revealed to you credit around R4000 without having the necessary costs. Their own computer software process is easy and commence easily transportable, getting merely a new unique exclusive details and commence career files. Some other dependable finance institutions own Calcium Credit and begin Earlier Quid.

People not be able to have got an ongoing revenue, particularly if abrupt costs occur. Many experts have difficult to result in the required costs well-timed, be a catalyst for deep concern costs and start monetary. Fortunately, a quick and easy credit south africa can provide the money that you should maintain expenditures under control. These refinancing options occur round on-line employs all of which will be authorized within minutes or even hr.

Kwalaflo

You may be coating financial hardships and want for a loan rapidly, that can be done to an minute progress via a S African lender. The bank will always blast the money straight away to the bank reason, and you may get the money in a few minutes or perhaps hour associated with utilizing. There are numerous what you should keep in mind while employing with an minute improve, such as the financial institution’azines terminology and start qualification codes.

While many lenders advertise

Many reasons exist for exactly why we all need funds advancements, including abrupt expenditures or perhaps immediate expenditures. The good news is, there are many banks that provide minute on-line loans in Azines Cameras to satisfy below enjoys. These refinancing options are used for any level and are available with certified banks in Kenya. To start, get a financial institution in your area and commence fill out a good online request.

If you need to qualify for a simple on-line improve, you should be the older involving Kenya and possess the true banking accounts. The amount of money you could borrow commences with your money and start financial evolution. If you document the application, the financial institution most likely evaluate it will and begin let you know for those who have been exposed. Whether or not popped, you’ll get a move forward the next day. Or else opened, you can test again later. Additionally it is required to assess financial institutions to find the best an individual for you personally.